Challenge

Ila Bank embarked on a mission to cater to the tech-savvy youth of the Middle East, where over 100 million millennials and over 50% of business owners were under the age of 35. The challenge was to create a fully-digital banking solution that would resonate with this demographic, offering holistic financial solutions and aligning products with their lifestyles.

From research to launch

Solution

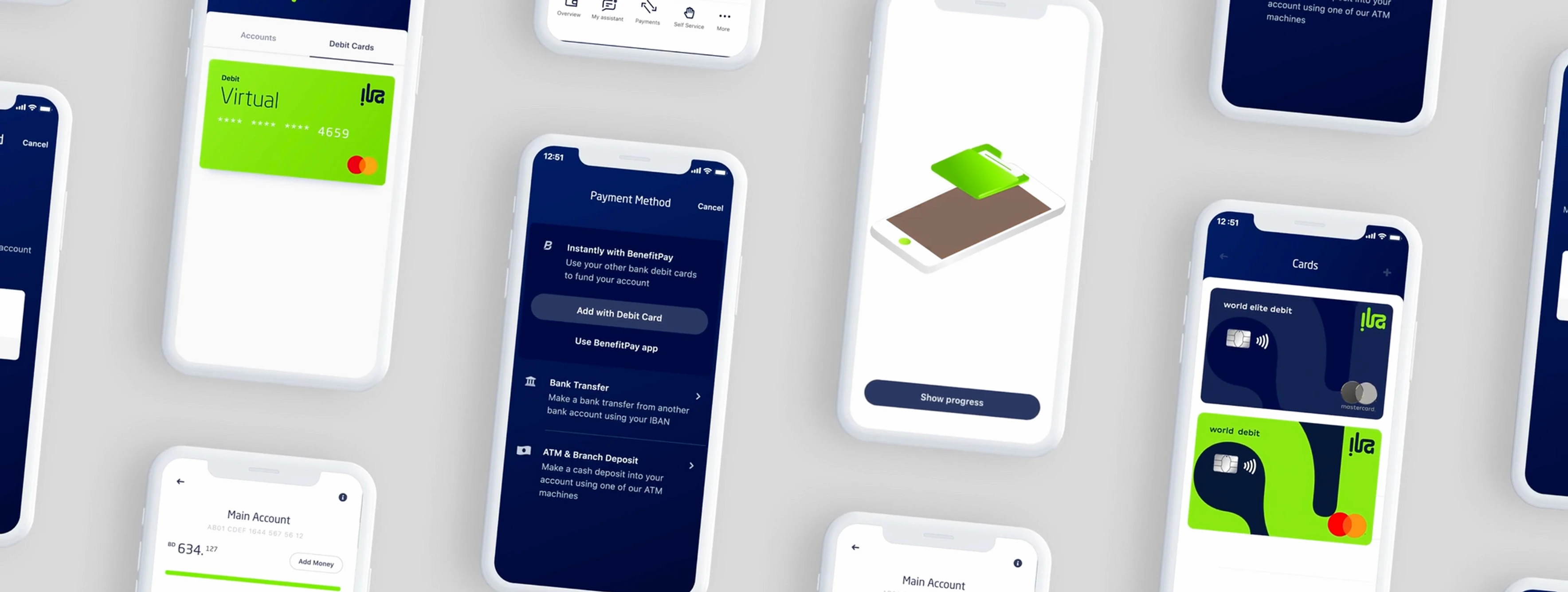

We drove the research and design phase all the way up to Ila Bank's groundbreaking launch—a pioneering digital bank that set fintech benchmarks in the Middle East. Through extensive market research and human-centered design, we introduced features like rapid onboarding, virtual card management, multi-currency accounts, and innovative savings pots.

Full digital onboarding

For the Arab region a big change; a full digital onboarding within minutes with just two forms of ID and a selfie.

Foreign currency accounts

Multiple foreign currencies available in one account is something completely new for Bahrain customers

Instant virtual debit card

Customers are issued a virtual debit card as soon as they onboard for immediate use for online transactions.

Fund the way you want

Also new: flexible funding options including in-app integration with the country's leading payment channel.

Results

Ila Bank achieved remarkable success, surpassing all commercial and business KPIs by 4.5 times within the first year of its digital offering.

The bank's CEO emphasized the importance of creating value for customers, attributing their success to a passionate team and the right technology partners.

Ila Bank transformed customer engagement by becoming a place of open communication, ensuring customers felt heard and valued.

The bank's customer-centric approach and tailored experiences contributed to their impressive growth.

The launch of Ila Bank marked Bank ABC's commitment to drive Bahrain's fintech sector, combining technology with a human-centric design to redefine banking.

Transform Awards 2020

Best Visual Identity in Financial Sector

Gartner 2020

Eye on Innovation award

Seamless Middle East 2020

Digital Banking Experience of the Year

Team a.o.

Victoria Fedorova

Paul van Raak

Steve Jude

Dan Williams

Lionell Schuring

Ila Bank

© 2023 Lionell Schuring